There has been no peace in the crypto market since May of this year. In just one month, we witnessed the collapse of Luna’s $40 billion financial empire overnight, the de-anchoring of Lido derivatives, the world’s largest decentralized node of ETH 2.0, the suspension of withdrawals from Celsius, the largest encrypted bank in the United States, and then it is said that it once held $18 billion. Three Arrows Capital Liquidation of USD Crypto Assets. When we connect these events, from Luna to stETH, from Celsius to Sanjian, we can find the subtle relationship between them and the development clues interspersed between them.

Two Martyrs: Celsius and Three Arrows Capital

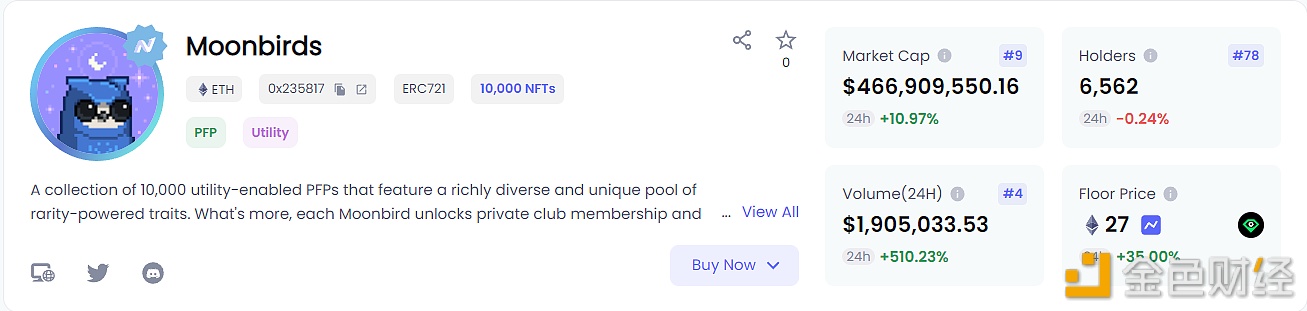

After the collapse of Luna, individuals in the encryption field were panicked, and operations visible on the chain became more frequent. After the recent de-anchoring of stETH, Celsius first encountered problems. This CeFi lending platform, which is well-known in Europe and America, has 1.7 million users, and manages more than $30 billion in assets, was finally forced to suspend all withdrawals due to the liquidity crisis. Another "martyr" encryption agency.

Before that, Celsius had lost a lot of user assets in various unexpected events: first, about 35,000 ETH, worth more than $70 million, was lost in the loss of private keys of Eth2.0 pledge company Stakehound, and then it was stolen in BadgerDAO. About 2,100 BTC and 151 ETH were lost in the theft incident, worth over $50 million. What's more serious is that Celsius has always deliberately concealed the truth, and even after the news was exposed, it still did not admit it, which directly hit users' confidence in the platform.

As one of the largest holders of stETH, Celsius was hit hard by the stETH de-anchoring event. As the value of stETH declined and the liquidity problems of the platform intensified, the platform encountered a serious run due to panic, and was forced to sell stETH to meet the needs of users to redeem assets. Finally, it had to open the "HODL mode" and suspend all accounts. Withdrawal and transfer activity. (BlockBeats note, how serious is the risk of stETH when institutions withdraw from Lido? The stETH and Celsius crises are described in detail)

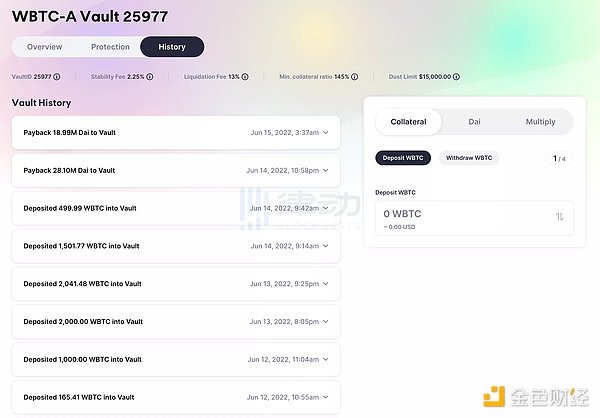

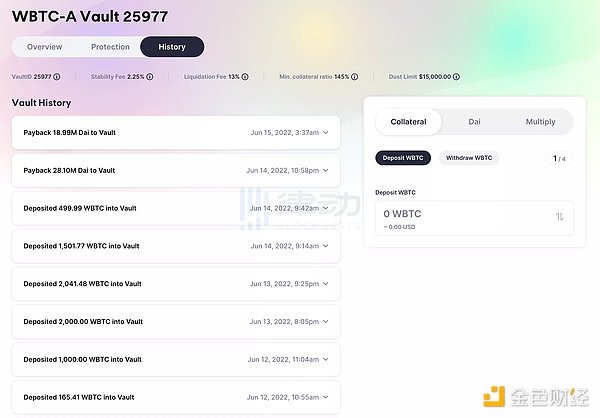

More seriously, as the market continues to decline, Celsius' hundreds of millions of dollars in DAI loans on the MakerDAO platform are also at risk of being liquidated. In the past two days, Celsius has been adding wBTC collateral to Maker and repaid Nearly 50 million DAI, bringing the mortgage ratio to 219%, which is barely free from the liquidation risk.

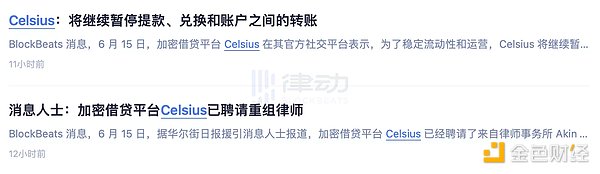

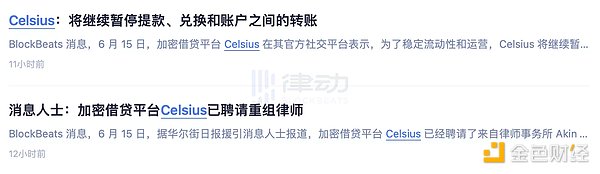

Faced with the beleaguered Celsius, Nexo, which is also a CeFi lending platform, extended an olive branch to Celsius, expressing its willingness to acquire its "remaining qualified assets", but the Celsius team did not respond. This blockchain revolution advocate who once shouted "the bank is bankrupt" can only rely on suspending withdrawals and restructuring lawyers to survive.

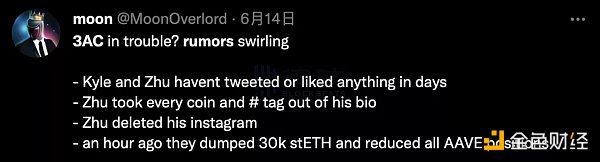

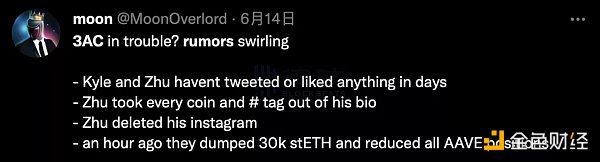

On the second day of the Celsius explosion, there were comments on Twitter that Three Arrows Capital was facing liquidation. It was found that its always public founder Zhu Su not only did not post for several days, but also deleted his Instagram account and modified it. Twitter Bio.

Soon after, Zhu Su broke the silence and wrote: "I am communicating with relevant parties and trying to solve the problem", and the community immediately exploded. Three Arrows Capital, an investment institution that once had assets of tens of billions and was one of the most active and influential in the industry, has now grabbed the spotlight of Celsius and has become the object of crowd watching and eating melons. , All kinds of behaviors have all been planed out.

According to The Block, Three Arrows has liquidated at least $400 million in liquidations with the market’s top lenders, and still has to repay other lenders after the liquidation. You must know that Three Arrows, as Luna's main endorsement agency, suffered huge losses during the UST crash, and in the past month Bitfinex's loss ranking, Three Arrows has always been on the list. In this stETH de-anchoring and selling, Sanjian's "activity" far exceeded Celsius, and stETH was sold in large quantities in order to repay debts.

Like Celsius, Zhu Su, who previously shouted about the super cycle and advocated the new L1 public chain ecology, has now become extremely silent, deleted the Token tag in his Twitter Bio, and admitted his misjudgment of the market.

But more notably, there seems to be a connection between the Celsius liquidity crisis and the liquidation of Three Arrows. In addition to the "top lending platform" mentioned in The Block's report, KOL trader Degentrading also pointed out on Twitter: Sanjian is Celsius' largest lender, and also has lending positions in mainstream CeFi lending platforms such as Genesis and BlockFi.

Although the liquidation of Three Arrows is not beneficial to borrowers, in terms of the problems exposed by Celsius, what these “crypto banks” urgently need to solve is the liquidity needs of users to redeem their deposits. And in the case of a crisis in its own liquidity, liquidating its own borrowers in exchange for liquidity seems a reasonable choice.

Perhaps because of this, Celsius gave Sanjian a Margin Call, turning it into a "sacrifice" to solve the crisis. However, other lending platforms such as Genesis and Nexo hurriedly released news to appease users’ confidence in order to prevent the fire.

The liquidation of Sanjian has also forced more institutions to become "incidental victims". Yesterday morning, a trading agency under Sanjian’s account posted that Sanjian took $1 million from its own trading account, apparently to fill the funding gap elsewhere. And this morning, DeFiance, a capital closely related to Three Arrows, also seemed to have problems, with its founder Arthur tweeting a tearful emoji.

In fact, it is not difficult to see from the decline of Celsius and Sanjian that the two events of the Luna crash and the decoupling of stETH have had a great impact. Taking the Luna incident as a watershed, the situation of encryption institutions has also changed a lot before and after.

Two Wrong Things: Luna and stETH

After the start of this market cycle, words such as "faith", "fundamentalism" and "All In" appear more frequently than ever before, and people are talking more about narratives than facts when investing. Over time, the "Irrresponsibly Long" meme has even become a condition for far-sighted investors to show off.

This atmosphere is also particularly evident among institutions, and everyone has established an "unshakable" consensus on hot narratives. The Lunatic army led by Delphi Digital and Galaxy Digital can be seen everywhere on Twitter, and Anchor’s 20% APY has become recognized as the “best safe haven in bear markets”; OG communities such as Bankless often post their beliefs about Ethereum 2.0 recharge, and liquidity pledges have also become The perfect solution for Ethereum 2.0 node verification.

But it is these strong consensuses that make institutions make fatal mistakes on Luna and Lido. Like the sub-credit crisis in 2008, the problem stemmed from excessive optimism and confidence. Before the Lehman Brothers explosion, the market was too optimistic about "rising house prices", and no one wanted to believe that almost "risk-free" mortgage securities would appear. question. Perhaps they were convinced by their own words, and the institutions did their best to achieve "Irrresponsibly Long". Before the collapse of Luna and the de-anchor of stETH, no one believed that these DeFi leaders with brand effects would still have fatal risks.

For Luna, UST's success has caused institutions to forget basic economics. The continuous and stable APY has brought a strong enough Lindy effect to UST, making people forget the terrible lock-up ratio of Anchor and the amazing market value of Luna. The leverage service agreement, so that most of the market value of UST in the end, is used to stack leverage in Anchor.

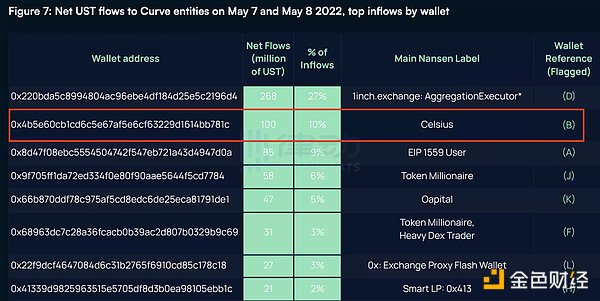

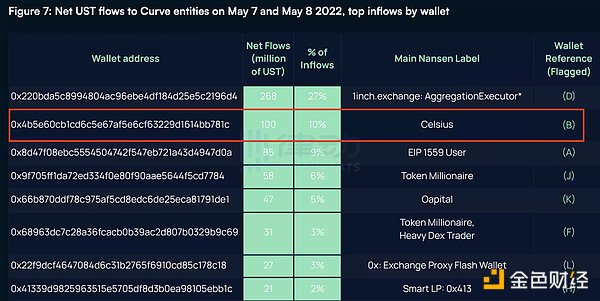

Celsius is also a large holder of UST, using the high APY provided by UST to achieve profit arbitrage. The platform first provides about 10% APY for stable coins such as USDT and USDC , absorbs the user's assets, and then converts it to UST and deposits it in Anchor to achieve 10% profit arbitrage, but the user is unaware of this until the occurrence of UST After the run, it was discovered that Celsius was the “big seller” of UST, and lost a lot of user assets during the collapse of UST.

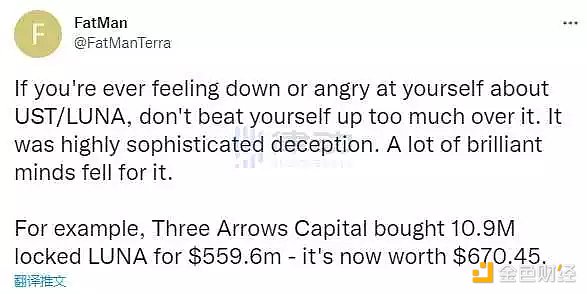

VCs and market makers such as Three Arrows, Galaxy Digital, Jump Trading, etc., selectively ignored Luna's strong financial attributes, and put the Terra ecology dominated by Anchor into the public chain narrative, keeping pace with Solana, Avalanche and other ecology, constantly Advocating "Solunavax". According to Terra Research Forum member FatMan, Three Arrows had purchased 10.9 million LUNAs for $559.6 million . Right now, they're only worth $670.45.

After a $40 billion financial empire evaporated overnight, the collapse of UST had a ripple effect, and several small stablecoins had de-anchored. Panic continued to rise, and finally even USDT had a short-term run. This crypto asset with one of the best liquidity was temporarily de-anchored due to liquidity.

To a certain extent, the short-term de-anchoring of USDT has been a strong signal from the market: after tens of billions of dollars have evaporated, liquidity is shrinking rapidly. Many stablecoin projects and ecosystems have also responded to this. The stable USN and USDD launched by NEAR and TRON have adopted the model of full or even over-collateralization. But the impact of the UST event is far more than that: since UST has developed into a cross-chain asset, its collapse will trigger different degrees of liquidation in each ecosystem. In other words, the collapse of Luna has ignited the lead of liquidity contraction.

However, institutions are too optimistic about the liquidity and demand of stETH. No one would have thought that the liquidity leads would burn to stETH, which has nothing to do with stable coins. Since the "collateral" of stETH is ETH 2.0, it cannot be taken out before the merger of Ethereum is completed. Therefore, unlike other liquid collateral certificates, stETH is a futures certificate of ETH 2.0, which does not necessarily maintain a 1:1 anchor with ETH. The price is completely determined by market demand.

A few months ago, there was no liquidity problem in the market, and the stETH-ETH pool prepared by Lido on Curve was fully able to meet the demand, so people simply understood stETH as an asset linked to ETH. At this time, one of the most popular strategies among institutions is to borrow ETH at a low interest rate of about 2%, and pledge on Lido to obtain a yield of about 4% of stETH production, and then use stETH as collateral to revolve lending on Aave Get out ETH and increase leverage in this seemingly low-risk way.

As one of the largest holders of stETH, Celsius has exchanged a large amount of user assets for stETH that cannot easily enter and exit the market through the liquidity pool. As can be seen in the figure below, Celsius owns nearly 450,000 stETH at its peak, and the platform will These stETH are deposited into Aave as collateral, and stablecoins or ETH are lent out to meet users’ redemption needs. And once the liquidity problem is detonated, the consequences will be very serious, because any drop in stETH will, strictly speaking, put Celsius in a situation of insolvency.

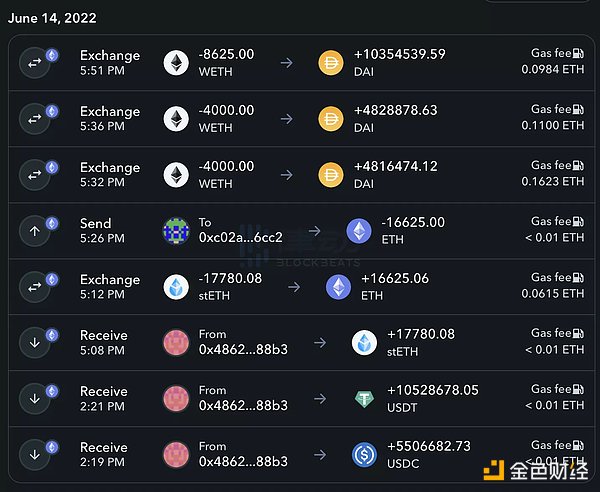

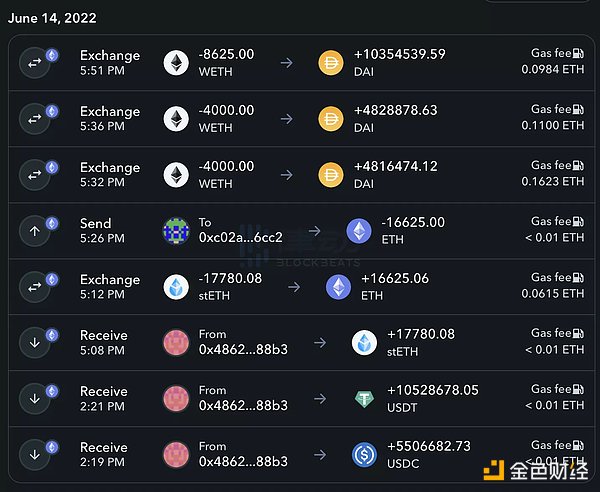

However, when Celsius realized this problem, it found that the liquidity on Curve could not meet the needs of the platform at all. Selling would lead to panic and runs. Without selling, it would not be able to meet the redemption needs of users, and was in a dilemma. And Sanjian is no exception. At the beginning of this year, it opened a large-scale ETH position and pledged it on Lido for stETH. Under the liquidation pressure of Celsius, Sanjian exchanged multiple stETHs for wETH at a discount, and then sold them all for DAI to repay the debt.

Of course, the mistakes that "destroyed" Celsius and Three Arrows Capital also happened to countless retail investors, and the problems exposed by Luna and stETH also reflected two clues that have been surrounding the crypto market in the past few months.

Two Clues: High Leverage Crisis and Liquidity Exhaustion

Yesterday afternoon, Paidun released news about the liquidation of Three Arrows Capital’s ETH assets one after another. According to the Aave platform, the suspected Three Arrows Capital wallet address (starting with 0x7160) has nearly 200 million US dollars of borrowings facing liquidation at any time, and this address is facing liquidation at any time. To avoid large-scale liquidations, debts are also continuously repaid on-chain.

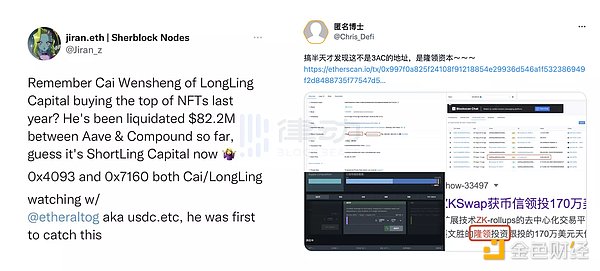

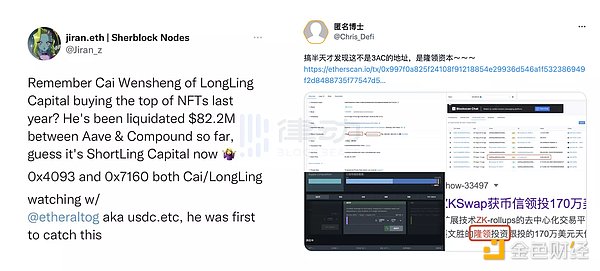

At that time, when the rumors of Sanjian's liquidation were hot, everyone regarded it as Sanjian's "self-defense counterattack". However, according to the disclosure of KOL on Twitter, the address may actually be the wallet address related to Longling Capital. This market liquidation can be regarded as a "spectacular scene" of whales diving collectively.

In addition to stETH, Sanjian itself also has a large number of loans to purchase GBTC positions. Since last year, the price difference of GBTC has continued to deteriorate, and it is currently -30%. .

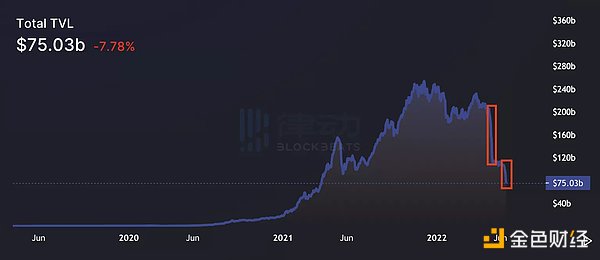

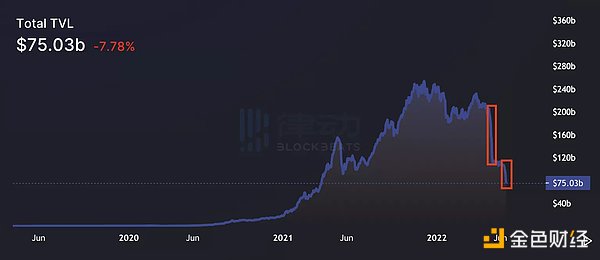

We can't help but wonder, just how much leverage was there during last year's second frenzied upcycle? From the overall TVL of DeFi in the figure below, we can perceive it slightly. The red box on the left is the Luna crash in early May, during which the TVL of the entire DeFi fell from $200 billion to around $120 billion, losing $80 billion; the red box on the right is the liquidation of institutions such as Celsius and Sanjian caused by stETH. TVL lost another $45 billion.

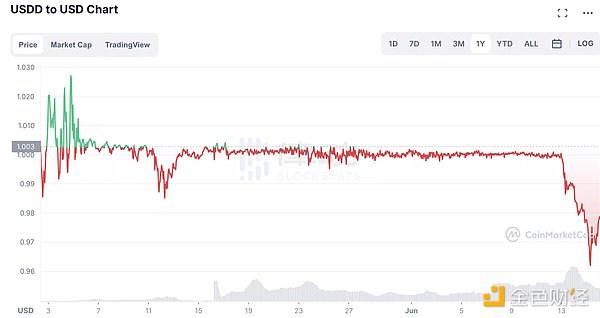

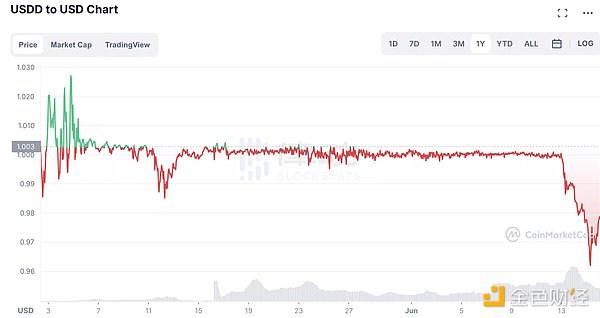

It is not difficult to see that the liquidation of mainstream ecology and institutions has caused the overall credit scale of the market to shrink rapidly, and may lead to continuous deleveraging. Just as Celsius has withdrawn capital, many other lending platforms will protect themselves by drawing credit from the market, further reducing the capital flowing in the market and further drying up the liquidity. For example, the TRON ecological stable currency USDD, with the support of hundreds of millions of dollars from the Federal Reserve, also failed to escape the fate of de-anchoring, and fell to a minimum of around $0.96 yesterday.

There is no doubt that the crypto market is going through its own Lehman moment. To stop the liquidation from worsening, it often needs external funds to rescue the market, but unfortunately, we have caught up with a historically rare wave of interest rate hikes: last night's FOMC meeting, The Fed raised the benchmark interest rate by 75 basis points again to a range of 1.50% to 1.75%; in Europe, Italian bond yields continued to rise, and the European Central Bank held an emergency special meeting yesterday to discuss coping strategies and advance interest rates.

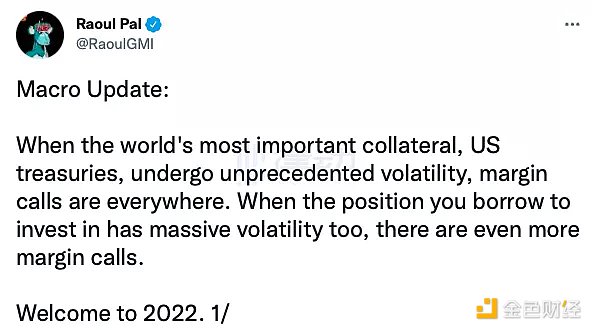

U.S. bond yields have also been rising recently, and U.S. stocks have continued to trend downward, clearly out of the “Correlation of One” situation: when the economy as a whole is facing severe liquidity reductions, people are often in a situation of “selling what they can sell” rather than “selling what they can.” As a volatile market, crypto will undoubtedly be one of the areas with the fastest liquidity crunch. Raoul Pal, a well-known macroeconomist and founder of Real Vision, also pointed out that when the important collateral such as U.S. Treasury bonds is experiencing unprecedented volatility, Margin Call will be everywhere.

Today's crypto market is facing the dilemma of double crunch of internal and external liquidity, and the bloodshed may continue. Celsius and Three Arrows Capital are not the first institutions to fall, nor will they be the last.